The Indian firms are doing trade all over the world. They have companies where they are the complete owners. And, in some cases, they have partners which are called joint project. In general, these projects need security for export and import. Similarly, their joint projects also need a guarantee to run successfully. Most importantly, the FERA and FEMA acts are applicable in the case of giving surety to such companies. Or else, they will need permission from the RBI – Reserve Bank of India. Above all, the main aim of both acts is to give security to these projects. Further, the surety is to help their dues, imports, exports, duties, and late payments. To clarify, we need extra details on this topic. Let’s discuss the acts one by one.

What are the FERA and FEMA Acts?

Money safety is the main thing when setting up a company. And, for our local and global projects, the Indian division has created some rules. The FERA Act stands for – Fraud Enforcement and Regulatory Act and is also known as the Foreign Exchange Regulation Act. And, it was created to control payments and foreign exchange in India. The FERA act was created in 1973 and it is an old act. The Parliament of India has passed this bill. On the other hand, the FEMA Act Stands for – Foreign Exchange Management Act. And, it was created to promote regular management of the foreign business in India. The FEMA Act was made up in 1999 and it is a new act. It was an alternate and an improvement in the old FERA act. Similarly, the parliament of India has passed this bill. Meanwhile, we suggest you check out the article to know the major differences between these acts. Further, this article will explain the acts one by one and give a clear review of both acts. So, let’s check out the difference between the two.

Difference between FERA and FEMA

Certainly, both the acts were created to control the Foreign Trade in India. But, these acts have key differences. Let’s compare the two.

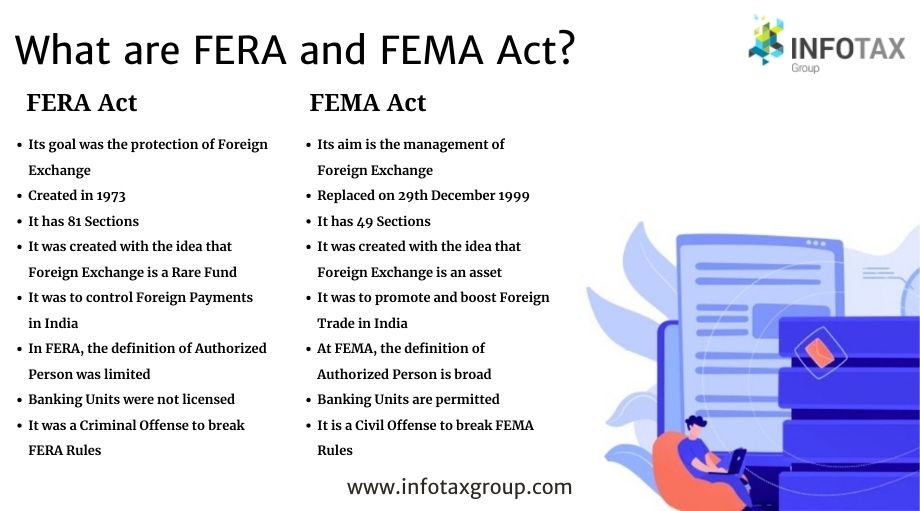

| Sr. No | FERA Act | FEMA Act |

| 1 | Its goal was the protection of Foreign Exchange | Its aim is the management of Foreign Exchange |

| 2 | Created in 1973 | Replaced on 29th December 1999 |

| 3 | It has 81 Sections | It has 49 Sections |

| 4 | It was created with the idea that Foreign Exchange is a Rare Fund | It was created with the idea that Foreign Exchange is an asset |

| 5 | It was to control Foreign Payments in India | It was to promote and boost Foreign Trade in India |

| 6 | In FERA, the definition of Authorized Person was limited | At FEMA, the definition of Authorized Person is broad |

| 7 | Banking Units were not licensed | Banking Units are permitted |

| 8 | It was a Criminal Offense to break FERA Rules | It is a Civil Offense to break FEMA Rules |

| 9 | No legal help to the person who breaks the rule | Provision of legal help to the person who breaks the rule |

| 10 | FERA has no provisions for the Trial | FEMA has provision for special Trial |

| 11 | FERA has the provision of direct punishment for those guilty of violating rules | Firstly, they have a provision of fine. Secondly, if the fine is not paid within the time, then the guilty will be imprisoned |

| 12 | Approval from the Reserve Bank of India was required before transferring the funds for external businesses | No need for approval from the Reserve Bank of India for external trade and fund transfer |

| 13 | FERA has no provision for IT | FEMA has provision for IT |

| 14 | FERA has strict rules | FEMA has flexible rules |

| 15 | FERA was the original act | FEMA succeeds the FERA |

Introduce FERA Act

The foreign enforcement and regulatory act is shortly known as FERA. In other words, it is known as the foreign exchange regulation act. At first, it came into power to control the worldwide payments and export/import of funds.In addition, it includes the buying of security and fixed assets. Firstly, the Indian parliament has proposed this bill when the foreign reserves were not good. Secondly, its main aim was to save the foreign exchange. Consequently, it will help in the growth of the Indian Economy. However, this law was applied to the entire country. So, all the people of India living in India or out of the country are covered under the FERA act. On the other hand, this act also targets the companies and firms of Indian worldwide firms that are working outside India. In short, these are the companies that are owned by an Indian. Further, it aims at the businesses that are under the control of the Indian people. So, this was all about the introduction of the FERA Act.

Introduce FEMA Act

The FEMA Act is also known as the Foreign Exchange Management Act. It came into power in the year 1999. Most importantly, it was to cancel and change the previous act FERA. Entire India comes under this act, such as all the companies and joint firms that are working outside India. Most importantly, the Indian people run these companies as a whole or in a joint venture. Moreover, if any person of these companies breaks the rules, the FEMA act will cover it even outside India. The main aim of this act is to ease foreign business. Further, it will promote and maintain the growth of the foreign trade market in India. To clarify, there is a total of 7 sections of this act. And, these acts have 49 sub-parts. In this act, the 12 sections deal with the operational part. And, the other 37 sections cover fines, requests, and other things. Above all, the system of FEMA is flexible and its original limit of the reserve was good.

Conclusion

To sum up, it was all about the FERA and FEMA Acts. For the very first time, the Indian agencies opened the gate of foreign exchange for the many sectors of the Indian Market. Above all, in the year 1997, the Tarapore Committee offered the changes in the current FERA act. And, these changes were to control the forex in the country. Later, the FEMA Act replaced the FERA act.